Personal Budgeting Made Easy

First and foremost, Happy NEW YEAR!! I hope you all had a great (and safe) New Years!

2020 is going to be very busy, but also so many things that I am looking forward to. We have five weddings (domestically and internationally), a couple trips to Europe, potentially buy a condo in San Diego, and potentially start a family (depending on timing of events). Why am I telling you this? Well, since we have so much coming up, we have to make sure we have the finances to do so! Did you know that the average American has about $38,000 in debt, excluding home mortgages? And meanwhile, living in San Diego is not cheap either! So I am going to tell you what Bryan and I do to save money for all of life’s events as well as save for future events.

A little background, when Bryan and I first got married we kept our own accounts and we did not get a joint savings account until a little before our 2 year anniversary. And then after 2.5 years of marriage this month, we actually just combined our checking accounts. We both still have personal checking accounts, but we have found it easier to keep track of everything we purchase on one account.

Starting October of last year, we completed Dave Ramsey’s Financial Peace University (FPU) course with our small group from our church. It was a 9 week course that walked us through the steps of how to get out of debt, stay on budget, and begin saving for retirement. And before we started the course, I remembered my parents completing Dave Ramsey’s FPU before there was an app to help keep track of our finances. And full disclosure, we do not follow the course to a tee. We use it mostly as a resource versus a lifestyle as Dave Ramsey probably intended.

So what do we use to create our budget? EVERY DOLLAR app! This has been our saving grace and the best thing is the app is FREE! You can buy the Plus option, which I believe links your bank accounts so it automatically enters everything into the app for you rather than entering it manually. But honestly, I would save the money and just enter it as you go. This app has helped us rein in our spending. When Bryan and I first got married, we used our credit cards to buy EVERYTHING! We always paid it off at the end of the month, and sometimes we would go into savings to pay it off at the end of the month, but we figured if we paid it off there was no harm right? Well, in the FPU course we learned that people who make purchases with credit cards were 40% more likely to spend more money. OUCH! Now, we use our debit card attached to our checking account and enter the amount spent in the appropriate budget spot. I love that we are able to see how much money is budgeted into that category, because if we don’t have the money, then we don’t spend it. It simply keeps us on track. And if we have any money left over at the end of the month, then we put it towards the debt we have to pay off debt faster.

Where do I even begin? When you have a couple hours, sit down with your bank statements and add up your average monthly income and then add up your average spending per month. Then also make a list of all your debt including the interest rates, balances, and due dates. Then start making categories and within each category place subcategories. For example, we have a category called, “Giving” and within that category we list all the organizations we give to monthly and the date that it is taken out of our account or is due. Other categories may include savings (different savings accounts), housing (all housing bills), transportation (gas, insurance, etc.), food (groceries, restaurants), and personal (clothing, nails, gym, etc.). Another category we have is labeled ‘miscellaneous.’ This is an important category to include (if possible) because things are destined to come up during the month that you did not plan for. For instance, you did not add your oil change that is due for your car into your transportation budget but you know it needs to be done. You could use your miscellaneous budget (if possible) to help cover that expense so you do not go into your savings. One nice thing about the Every Dollar is that it comes pre-loaded with categories that you may forget about. And if you need to add more it is easy to do so too, or if a category doesn’t apply to you either, you can delete it! This app is really easy to use and very customizable.

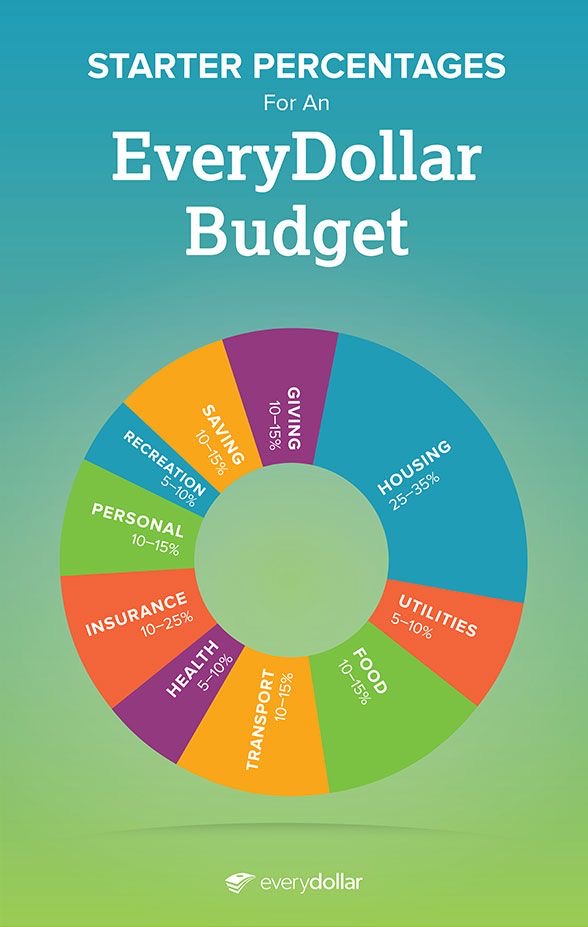

If you don’t know where to start, there is another rule called 50/30/20. 50% of your income goes to needs such as groceries, housing, bills, etc. 30% goes to wants which includes shopping, restaurants, gym membership. This category would also include saving for a vacation or car too. The remaining 20% goes to savings like retirement, paying off debt, or emergency savings. We have not followed this rule, but I am sure it is just as helpful. Here is what our course taught us when you break down your income.

Now, the first few months of budgeting can be a little difficult only because you are estimating how much you need in each category/subcategory. So whatever you do, stay with it and adjust them appropriately. It will eventually start working. The other nice thing about using Every Dollar is that you are able to copy over your budget to the next month and adjust appropriately so you don’t have to spend multiple hours again doing it.

If you are unmarried, it can be very helpful to get an accountability partner to keep you on budget. Find a friend or a family member to help keep you on track. For some people carrying cash in envelopes is better because it is more of a physical act of paying versus just paying with a plastic debit card. Now, some people have asked, “can I just use a credit card and stick to my budget?” But when it comes down to it, it becomes more of a mental game because you actually see your bank account draining. Trust me. Bryan and I tried this too. We wanted the best of both worlds; we wanted to stay on budget and to earn points with our credit cards as well as keep an amazing credit score. But by using our credit card all the time we ended up spending a lot more money. Since changing to using debit card or cash we have a lot more money left over at the end of the month that goes to savings or paying off debt.

Now, go start paying off your debt and save more money! I hope this was helpful for you guys! if you have any questions, please don’t hesitate to reach out! I would love to help! 🙂

xoxo,

T

Good post but I was wondering if you could write a litte more on this topic?

I’d be very thankful if you could elaborate a little bit more.

Thank you!

I always spent my half an hour to read this weblog’s articles or reviews all the time

along with a cup of coffee.

Wonderful article! We are linking to this great content on our website.

Keep up the great writing.

Hello my loved one! I wish to say that this post is awesome, great written and include

approximately all vital infos. I would like to see extra posts like this .

Hello there, I discovered your website via Google at the same time as looking

for a related matter, your website came up, it appears good.

I have bookmarked it in my google bookmarks.

Hello there, just became aware of your weblog through Google, and found

that it is truly informative. I am going to be careful for

brussels. I will be grateful if you proceed this in future.

A lot of other people will be benefited from your writing.

Cheers!

Hi there i am kavin, its my first occasion to commenting anywhere, when i read this paragraph i thought i could also create comment due to this brilliant article.

Hi there, just wanted to tell you, I loved this blog post.

It was inspiring. Keep on posting!

Hi, i read your blog from time to time and i own a similar one and i

was just curious if you get a lot of spam comments? If so how

do you prevent it, any plugin or anything you can suggest?

I get so much lately it’s driving me mad so any assistance is

very much appreciated.

Howdy! I could have sworn I’ve been to this site before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely happy I found it and I’ll be bookmarking and checking back frequently!

Asking questions are actually good thing if you

are not understanding anything completely, except this paragraph gives fastidious understanding yet.

What a material of un-ambiguity and preserveness of precious experience

about unexpected feelings.

Some genuinely choice articles on this internet site, saved to favorites.

Can I just say what a reduction to find somebody who really is aware of what theyre talking about on the internet. You undoubtedly know learn how to carry an issue to light and make it important. Extra folks have to read this and understand this side of the story. I cant imagine youre no more fashionable since you positively have the gift.

Heya i’m for the first time here. I came

across this board and I find It truly useful

& it helped me out a lot. I hope to give something back and aid others like you aided me.

I think this is among the most significant information for me. And im glad reading your article. But want to remark on some general things, The website style is wonderful, the articles is really excellent : D. Good job, cheers

{{Blogs are a fantastic way to share your ideas as well as ideas with the world. They are likewise a wonderful method to build your personal brand name.

Blog sites are a terrific method to share your ideas as well as ideas with the globe. They are additionally an excellent means to develop your individual brand name.A blog site is a website that contains write-ups or messages on a specific subject. Blogs can be used for individual use, organization usage, or both.

Some truly nice stuff on this web site, I love it.

Your style is so unique in comparison to other

folks I’ve read stuff from. Thank you for posting when you’ve got the opportunity, Guess I

will just book mark this site.

There’s certainly a lot to know about this topic. I like all the points you have made.

I do accept as true with all the concepts you’ve introduced on your post.

They’re really convincing and will definitely work.

Nonetheless, the posts are too brief for beginners.

Could you please lengthen them a little from subsequent time?

Thanks for the post.

Simply want to say your article is as astonishing.

The clearness in your put up is just cool and that i

can assume you are an expert on this subject. Fine along with your permission let me to grab your RSS feed to keep up to

date with forthcoming post. Thanks a million and please continue the gratifying work.

First off I want to say fantastic blog! I had a quick question that I’d like to ask if you don’t mind.

I was interested to know how you center yourself

and clear your mind prior to writing. I have had difficulty clearing my mind in getting my

thoughts out. I do enjoy writing but it just seems like the first

10 to 15 minutes tend to be wasted simply just trying to figure out

how to begin. Any ideas or hints? Thanks!

Thanks , I have just been searching for information about this subject for a

long time and yours is the best I have came upon so far.

However, what about the bottom line? Are you sure concerning the supply?

I really like what you guys are up too. This kind

of clever work and coverage! Keep up the wonderful works guys I’ve added you

guys to blogroll.

Hmm it seems like your site ate my first comment (it was extremely long) so I guess

I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog.

I as well am an aspiring blog blogger but I’m still new to the whole thing.

Do you have any tips for first-time blog writers?

I’d certainly appreciate it.

Feel free to visit my blog :: special

This article is in fact a good one it helps new the web viewers, who are wishing for blogging.

Howdy! Do you know if they make any plugins to safeguard against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

whoah this weblog is great i love studying your articles.

Keep up the good work! You already know, many persons are

hunting round for this information, you can help them greatly.

I have been browsing online more than 4 hours today, yet I never found any interesting article like yours.

It’s pretty worth enough for me. In my opinion, if all website

owners and bloggers made good content as you did,

the net will be much more useful than ever before.

My website: special

Hey there! I could have sworn I’ve been to this blog before but after reading through

some of the post I realized it’s new to me. Nonetheless, I’m definitely happy I found it and I’ll be book-marking and

checking back frequently!

Hey there, I think your website might be having browser compatibility issues.

When I look at your website in Chrome, it looks fine but when opening in Internet Explorer, it

has some overlapping. I just wanted to give you a quick heads up!

Other then that, great blog!

I am really inspired with your writing talents and also with the layout to your weblog. Is that this a paid subject matter or did you customize it yourself? Anyway keep up the excellent quality writing, it’s uncommon to look a nice weblog like this one nowadays..

Fantastic goods from you, man. I’ve understand your stuff previous to and you’re just too wonderful. I actually like what you’ve acquired here, really like what you are stating and the way in which you say it. You make it entertaining and you still care for to keep it sensible. I can’t wait to read much more from you. This is really a great website.

Top site ,.. amazaing post ! Just keep the work on !

I do believe all of the ideas you’ve offered to your post. They’re very convincing and can definitely work. Nonetheless, the posts are very quick for newbies. Could you please prolong them a bit from next time? Thank you for the post.

After I originally commented I clicked the -Notify me when new feedback are added- checkbox and now each time a remark is added I get four emails with the same comment. Is there any way you can take away me from that service? Thanks!

Whats up! I simply want to give a huge thumbs up for the great data you could have right here on this post. I can be coming again to your blog for extra soon.

Woah! I’m really loving the template/theme of this site. It’s simple, yet effective. A lot of times it’s very difficult to get that “perfect balance” between superb usability and visual appearance. I must say you have done a amazing job with this. Additionally, the blog loads very fast for me on Safari. Outstanding Blog!

Hey there! I could have sworn I’ve been to this site before but after checking through some of the post I realized it’s new to me. Nonetheless, I’m definitely delighted I found it and I’ll be bookmarking and checking back frequently!

Hiya, I am really glad I’ve found this information. Nowadays bloggers publish only about gossips and web and this is actually frustrating. A good site with interesting content, this is what I need. Thanks for keeping this website, I’ll be visiting it. Do you do newsletters? Can not find it.

I do consider all the concepts you have offered in your post. They are really convincing and will definitely work. Nonetheless, the posts are too quick for starters. May you please lengthen them a little from subsequent time? Thanks for the post.

Fantastic beat ! I would like to apprentice whilst you amend your web site, how could i subscribe for a blog site? The account helped me a applicable deal. I had been a little bit acquainted of this your broadcast offered bright transparent idea

https://prednisoneall.top/

Medication information leaflet. Long-Term Effects.

cost of bactrim in the USA

Some what you want to know about drug. Get here.

Hello There. I found your blog the usage of msn. That is a really well written article. I抣l make sure to bookmark it and return to read more of your useful information. Thank you for the post. I抣l definitely return.

I dugg some of you post as I thought they were very useful handy

Fun, exciting and innovative on-the-go entertainment, Bonza Spins is your Mob.io to spin with the dealer or play by yourself or with friends.

https://www.australiaforeveryone.com.au/news/how-to-choose-the-best-online-casino-for-aussie-players/

Looking for online pokies in Australia? You’ve come to the right place. With our extensive selection of online casinos, we have everything you need to kick back and enjoy your favourite slots.

https://blogs.uwa.edu.au/austech/free-casino-games-with-no-deposit-bonus/

Our casino promotions are designed to attract new players and retain existing ones. From free chip deals and no deposit bonus codes, to exclusive events and free credit every week … you’ll have a great time!

Game Craps>

What i don’t understood is actually how you are not really

a lot more well-appreciated than you might be now. You are so intelligent.

You already know thus significantly when it comes to this matter, made me individually imagine it from

a lot of varied angles. Its like men and women are not interested until it

is something to do with Woman gaga! Your individual stuffs great.

All the time handle it up!

My homepage tracfone 2022

Let me just get straight to the point; I saw your blog and I think you would be a great fit for our company :-). We are currently paying upwards of $70/hour for English translators. We are looking for people who are reliable, hardworking, and willing to work long-term. English fluency is preferred, and I don’t think you should have any problems with this requirement. We are an online based company from North Carolina. Interested? Apply here: https://msha.ke/freedomwithtay

Bitcoin Casino Review – Check out these top Bitcoin casinos and read our top rated reviews.

https://bestbitcoincasino.review/games/keno

Artificial intelligence creates content for the site, no worse than a copywriter, you can also use it to write articles. 100% uniqueness, scheduled posting to your WordPress :). Click Here:👉 https://stanford.io/3FXszd0

Steam Desktop Authenticator – Desktop emulator of the Steam authentication mobile application.

steam authenticator

Bitcoin casino list is a directory of the best and safest online casinos that accept bitcoin deposits.

Betchaser Casino Review>

Our casino games come with many benefits and promotions, so you can enjoy even more of the action! Read on for special offers and bonuses.

https://bestbitcoincasino.review/games/video-poker

Earn and enjoy great rewards now with our many special offers. Choose the promotion that suits you best and claim all savings.

https://bestbitcoincasino.review/games/video-poker

Medicament information. Drug Class.

lisinopril

All information about meds. Read now.

Drugs information for patients. Cautions.

get plavix

Some information about medicament. Get information here.

Despite having a relatively small population, Aussies love to gamble. The city of Sydney is home to many of Australia’s top casinos and gaming venues and attracts millions of people every year. If you’re an active player and looking for a better way to enjoy the experience, our guide below helps you choose the best online casino for your needs.

https://www.australiaforeveryone.com.au/news/how-to-choose-the-best-online-casino-for-aussie-players/

A casino platform can be found online, via a web browser of an online connection to the Internet. Online casinos offer real money gambling. The games are controlled directly by the casino and there is little risk of someone cheating your money. Players use their own credit cards or bank accounts to deposit money into these online casinos. They usually allow you to play for real money casino games at least once before withdrawing it from the site.

https://eglobaltravelmedia.com.au/2022/11/16/how-to-find-online-pokies-for-australians/

Medicine information. Long-Term Effects.

stromectol order

All news about drugs. Read information now.

Aussie players are always eager to play, but they also have certain requirements and wants when it comes to choosing the best online casino. The first and most important task is to make sure you visit a trusted, experienced and regulated site.

https://www.australiaforeveryone.com.au/news/how-to-choose-the-best-online-casino-for-aussie-players/

Online pokies for australians. With the best selection of online chips in Australia, we have it all from Jupiters to Crown and Clubbet.

https://blogs.uwa.edu.au/austech/free-casino-games-with-no-deposit-bonus/

Medicament information. Short-Term Effects.

sildenafil buy

Some what you want to know about meds. Get here.

ashwagandha dosage for weight loss

Johnnie kash casino. Johnnie kash login casino. Johnnie Kash deposits, payouts and bonuses!

johnny kash kings casino login

Drugs information. Generic Name.

propecia buy

All what you want to know about medicament. Read here.

This is King Johnnie Kash VIP Casino and it’s main building is the Port Royale Casino. You will find every game you could possible want and need to gamble at from roulette, craps, slot machines, video poker, blackjack and video baccarat. Also available is an impressive gaming area that includes an on site casino for table games.

kingjohnnir

Pills information leaflet. Generic Name.

cheap maxalt

All information about meds. Read now.

King Johnnie Kash VIP Casino is the most secure and fastest gaming experience. We offer numerous popular table games. With an array of slots, including video poker and scratch cards, you can enjoy playing at King Johnnie Kash anytime, anywhere! We also provide instant access to our website with a mobile screen that shows you each of our tables and gaming options.

king johnnie casino au

ivermectin stromectol where to buy

King Johnnie Kash VIP Casino is the premier online casino of choice for sports and poker players.

king johnnie

Medication information sheet. Cautions.

how can i get pregabalin

Actual trends of medicament. Get information here.

Johnnie Kash is both a highly successful and charismatic Philippine television host, actress and recording artist. Amassing almost 4 billion views on social media since his start in 2013 by posting videos of his performances and concerts. He became just the second Filipino celebrity to top YouTube’s “most subscribed” list in December 2017. Johnnie Kash: THE OFFICIAL SON OF THE YEAR

kash kings vip login

ashwagandha benefits

Drugs information. Cautions.

levaquin online

Everything trends of medicines. Get information now.

King Johnnie Casino is a leading online casino offering great bonuses and no deposit offers. Discover the best games with unrivalled quality and care free gameplay.

king johnnie free spins

what is prednisone used for

Medication information leaflet. Drug Class.

propecia

Best news about drug. Get information now.

King Johnnie Casino – Exclusive Bonus Code Giveaway King Johnnie Casino is a new casino from the same team that brought you Three Roses Poker. It’s licensed to operate legally in the UK and offers many great promotions

king johnnie casino bonus codes 2022

Medicines prescribing information. Cautions.

cleocin

Some about medication. Get here.

erotic strip

johnnie kash vip login, johnnie kash vip, johnnie kash in the 60s

jackpot jill casino login australia

Meds information for patients. What side effects can this medication cause?

get levaquin

Actual trends of drug. Get information now.

Welcome to King Johnnie Casino, now the Crown Jewel of Gaming. We are an AAA casino name trusted by players and rewarded by slot enthusiasts. Get 10 free spins on Starburst and use our bonus codes to get $1000 free spins on Starburst or get a 20% deposit match up to $200 on your first deposit!

7bit casino no deposit bonus

Pills information leaflet. Generic Name.

celexa order

Everything trends of medication. Read information here.

Medicine prescribing information. Brand names.

promethazine without dr prescription

Best trends of medicines. Get information now.

King John is the best place to play online. The casino offers one of the largest welcome bonuses, including high-roller games, poker and exclusive treatment.

casino rocket no deposit kings

Medicine information for patients. Drug Class.

fosamax brand name

Some trends of medicines. Read here.

King Johnnie Kash VIP Casino is a high-quality online casino for you to earn money with lots of fun. Enjoy the top slot machines like Dazzling Diamonds, NetEnt mega MOOLAH, Gonzo’s Quest and more.

king jhonny

Drug prescribing information. Cautions.

generic lisinopril

Actual news about drug. Get information here.

Johnny Kash Kings VIP Login is the right place to enjoy unlimited access to all his latest music, locked tracks, new releases and much more. You will find your way around the website in no time, and what’s more, we make sure that there are loads of exclusive content available for you to enjoy.

king johnny kash casino login

Meds information leaflet. What side effects?

flagyl

Actual trends of drugs. Get here.

Johnny Cash Casino is an online casino with 100% deposit match bonus, fun and exciting games and the best payout percentages.

johnnie kash kings sign up

lisinopril 20 mg

King Johnnie Kash is a VIP Casino developed by Johnnie Kash himself. It is the best online casino in Pakistan that offers at least 7,500+ deposit and withdrawal methods. It has all you need to have fun and earn money – games, winnings, credit or cash-out options and promotions!

casino king review

lisinopril 20 mg

clindamycin dosage

http://xn--23-dlcduho3aq4a.xn--p1ai/index.php?subaction=userinfo&user=dizzycpitta9486

colchicine mechanism of action

coloccini

Okay, this might be a little bit random, but I saw your blog and had to ask, are you interested in a translation job? I know I’m a stranger but I felt like doing a good deed today by alerting a couple people that a good position has opened up here: https://msha.ke/freedomwithtay and they pay sometimes even $70/hour. Okay, they won’t always give that amount, I only made around $400 last week, but it’s part time and when times are tight, every little bit helps. Hope it helps, and my apologies if you’re not interested. Have a great day/evening!

levaquin tablets

Drugs information sheet. Effects of Drug Abuse.

colchicine

Best news about medicines. Read information here.

Drugs information sheet. Brand names.

lisinopril

Best trends of meds. Read information here.

Medicine prescribing information. Brand names.

where to get clindamycin

Everything about meds. Get now.

https://meowkiss.com

I just like the helpful information you supply for your articles. I will bookmark your blog and take a look at once more right here regularly. I’m rather sure I will be informed a lot of new stuff right right here! Good luck for the following!

Medicines prescribing information. Long-Term Effects.

zithromax

Everything what you want to know about medicine. Get here.

Medicine information leaflet. Brand names.

diflucan

Some about pills. Get information here.

Pills information leaflet. What side effects can this medication cause?

cost levaquin

Best trends of meds. Get information here.

Drug prescribing information. Effects of Drug Abuse.

propecia

Best trends of medicine. Get information now.

Pills information leaflet. Drug Class.

pregabalin pill

Some trends of medicament. Get now.

Meds information leaflet. Generic Name.

abilify pills

All news about pills. Get here.

great submit, very informative. I’m wondering why the other experts of this sector do not notice this. You should proceed your writing. I’m sure, you’ve a great readers’ base already!

Thanks for discussing your ideas in this article. The other issue is that each time a problem appears with a laptop or computer motherboard, people today should not take the risk regarding repairing this themselves because if it is not done correctly it can lead to permanent damage to the whole laptop. It’s usually safe to approach any dealer of any laptop for any repair of motherboard. They will have technicians with an experience in dealing with mobile computer motherboard problems and can make the right diagnosis and execute repairs.

I loved as much as you will receive carried out right here. The sketch is attractive, your authored subject matter stylish. nonetheless, you command get got an edginess over that you wish be delivering the following. unwell unquestionably come more formerly again since exactly the same nearly very often inside case you shield this increase.

Medicines information. Generic Name.

order propecia

Everything about pills. Read now.

Medicine prescribing information. Long-Term Effects.

buy generic levaquin

All news about meds. Get information here.

Hey, honestly your site is coming along :-), but I had a question – it’s a bit slow. Have you thought about using a different host like propel? It’d help your visitors stick around longer = more profit long term anyway. There’s a decent review on it by this guy who uses gtmetrix to test different hosting providers: https://www.youtube.com/watch?v=q6s0ciJI4W4 and the whole video has a bunch of gold in it, worth checking out.

Medicament prescribing information. Brand names.

strattera

Some information about medicines. Get information now.

Drug information. Long-Term Effects.

colchicine without insurance

Best about medication. Get information now.

i want to share hot girls with you for free

Pills information. Effects of Drug Abuse.

levaquin tablet

Best trends of medicament. Get now.

Medicine information for patients. Effects of Drug Abuse.

order levaquin

Some about medication. Read information now.

Do you like BTS too? because im part of the army

Drugs prescribing information. Brand names.

neurontin buy

Actual news about medicines. Get here.

Drugs prescribing information. Generic Name.

zofran pill

Some information about drugs. Read now.

Casino Mate is a result of over 15 years of research and development. It is a tool which allows players to easily follow the games offered and the odds that they provide, keeping them up to date on everything. The app also helps users to win more and increase their chances of getting a bonus.

https://www.emoneyspace.com/forum/index.php/topic,532308.0.html#:~:text=If%20you%20want%20to%20receive%20really%20useful%20online%20casino%20bonuses%20you%20can%20visit%20https%3A//1casino%2Dmate.com/bonuses

Hey, honestly your site is coming along :-), but I had a question – it’s a bit slow. Have you thought about using a different host like propel? It’d help your visitors stick around longer = more profit long term anyway. There’s a decent review on it by this guy who uses gtmetrix to test different hosting providers: https://www.youtube.com/watch?v=q6s0ciJI4W4 and the whole video has a bunch of gold in it, worth checking out.

Casino Mate is the perfect blend of excitement and relaxation. Our games have been designed for a great experience for players of all skill levels, and our friendly support team is ready to help you every step of the way!

https://www.ccra.com/wp-content/plugins/wp-security/?offer-from-online-casino-mate.html

Medication prescribing information. Effects of Drug Abuse.

zoloft

All what you want to know about drugs. Read here.

https://pedagog-razvitie.ru/resnici.html

One thing I would really like to say is the fact that before getting more computer system memory, consider the machine into which it can be installed. Should the machine can be running Windows XP, for instance, the actual memory limit is 3.25GB. The installation of more than this would easily constitute a new waste. Make sure that one’s motherboard can handle your upgrade volume, as well. Good blog post.

Medicines information sheet. Effects of Drug Abuse.

fosamax

Actual news about pills. Read information here.

Casino Mate is a mobile gaming platform that helps you improve your game every time.

https://bushwalk.com/advertising/pages/casino-mate-review.html

Medicament information. Effects of Drug Abuse.

can i order stromectol

Some news about medicine. Read information here.

Medicines information sheet. Effects of Drug Abuse.

neurontin

All information about drug. Read now.

Casino Mate is a unique and exciting card game where players can win up to x10 of their real money deposit. It has all the popular casino games: blackjack, roulette, craps and more.

https://cartagena-colombia-travel.activeboard.com/t68864981/ive-finally-found-a-good-welcome-bonus-offer/

Very interesting subject, thanks for putting up.

https://dom-rabochiy.ru/

I was very pleased to search out this web-site.I wished to thanks for your time for this wonderful read!! I undoubtedly enjoying each little bit of it and I’ve you bookmarked to check out new stuff you weblog post.

I would like to thank you for the efforts you’ve put in writing this blog. I’m hoping the same high-grade site post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own site now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

https://dom-rabochiy.ru/

Medicament information sheet. Brand names.

cleocin without insurance

Everything about meds. Read information here.

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove people from that service? Bless you!

Meds information leaflet. Brand names.

mobic brand name

Some about medicines. Get now.

Casino Mate is a revolutionary new way to enjoy your favorite casino games! We make it easy for you to play slots, bingo, roulette and poker with friends on any device.

https://www.vingle.net/posts/4874540

You actually make it seem really easy together with your presentation but I in finding this topic to be really something which I think I might never understand. It seems too complex and very vast for me. I am taking a look forward on your subsequent publish, I will try to get the dangle of it!

Casino Mate is a Twitter-based game that gives you a chance to play the real-life casino tables, without the drama. Simply follow the rules and start eliminating your friends from the overall points table.

https://attorneykennugent.com/news/games-at-mate-casino.html

I discovered your weblog website on google and test a couple of of your early posts. Proceed to keep up the excellent operate. I just additional up your RSS feed to my MSN News Reader. Seeking forward to reading more from you afterward!…

Wow! This could be one particular of the most helpful blogs We have ever arrive across on this subject. Actually Excellent. I am also an expert in this topic therefore I can understand your effort.

Hi, i think that i saw you visited my web site thus i came to 搑eturn the favor?I am attempting to find things to enhance my site!I suppose its ok to use a few of your ideas!!

It抯 really a great and useful piece of info. I am glad that you shared this useful information with us. Please keep us informed like this. Thanks for sharing.

Play real money casino games in the browser, using friendly real-time chat to help you with everything from gaming experience and questions, to getting a loan and bonus deposits.

https://cryptotalk.org/topic/364374-1casino-mate-is-the-place-to-relax-making-money/?tab=comments#comment-17408732

Excellent read, I just passed this onto a colleague who was doing some research on that. And he actually bought me lunch as I found it for him smile So let me rephrase that: Thank you for lunch! “Too much sanity may be madness. And maddest of all, to see life as it is and not as it should be” by Miguel de Cervantes.

Pills information sheet. What side effects can this medication cause?

prednisone medication

Everything news about medicine. Get here.

Forget the fruit machines and slot machines, walk away with your friends and win real money with Casino Mate! It’s casino fun that’s easy to play. Simply choose a prize and pay %10 in bonus to claim the winnings, then choose another prize and so on. Watch as your friends play amongst themselves while you are staking them.

https://zohofinance.uservoice.com/forums/283818-zoho-books/suggestions/44556690-what-is-csgo-skin-gambling#:~:text=Same%20here…%20Last%20months%20I%20started%20to%20use%20online%20casinos%20like%20https%3A//1casino%2Dmate.com/%20to%20make%20some%20money%20while%20I%27m%20sitting%20without%20job%20because%20of%20recession

Medicines information. Generic Name.

xenical

Best about medicament. Read now.

I will immediately grab your rss feed as I can not find your email subscription link or newsletter service. Do you have any? Kindly let me know so that I could subscribe. Thanks.

I like your writing style truly enjoying this web site.

Pills information sheet. Short-Term Effects.

propecia price

Some news about medication. Read information here.

hodix

I抎 must check with you here. Which is not something I normally do! I take pleasure in studying a post that may make individuals think. Also, thanks for permitting me to comment!

pissing threesome

I’d must verify with you here. Which isn’t one thing I usually do! I take pleasure in studying a post that will make folks think. Additionally, thanks for permitting me to comment!

nylon fetish

milf boobs

Are you looking for a gaming experience unlike anything you’ve ever seen? Head online today to play and explore our virtual world, with thousands of games and challenges at your fingertips.

https://www.latestnigeriannews.com/p/2221838/bonza-spins-casino-aussie.html

Thanks for expressing your ideas. I might also like to express that video games have been at any time evolving. Today’s technology and revolutions have helped create sensible and active games. These types of entertainment games were not as sensible when the real concept was first being tried. Just like other areas of technological innovation, video games too have had to develop as a result of many generations. This itself is testimony for the fast growth of video games.

Drugs information. Generic Name.

abilify without insurance

All news about medicine. Read information here.

Medicament information. Brand names.

neurontin generics

Actual about meds. Get information here.

Whether you are looking for table games, slots, live dealer gaming, keno or other forms of gaming entertainment GSN Casino provides a one stop experience.

https://www.australiaforeveryone.com.au/news/how-to-choose-the-best-online-casino-for-aussie-players/

Medicament information. Effects of Drug Abuse.

my-med-pharm.top buy

Some what you want to know about medicines. Get information here.

Drugs information. Brand names.

colchicine tablet

Best news about medicines. Get now.

Medicine information sheet. Effects of Drug Abuse.

stromectol

Actual news about drugs. Read here.

Medication information for patients. Drug Class.

avodart without rx

Best what you want to know about medicament. Read information now.

Medicines information sheet. Generic Name.

avodart sale

Some trends of drugs. Read information now.

Online casino is a wonderful place to play. It is simple, convenient, and you can have the confidence that you are going to get the best entertainment ever. Online casino offers several benefits for gamblers and it’s one of the most popular ways for people who love to gamble. Here are some reasons we should consider before starting playing at online casinos:

https://www.maltafootball.com/2022/12/14/fair-go-casino-best-online-casino-in-australia/

Meds prescribing information. Cautions.

prednisone

Actual trends of medicines. Read here.

Drug prescribing information. Brand names.

propecia

Best about medication. Read now.

It’s my belief that mesothelioma can be the most dangerous cancer. It has unusual properties. The more I actually look at it the more I am certain it does not work like a true solid cells cancer. In the event that mesothelioma is usually a rogue virus-like infection, then there is the probability of developing a vaccine in addition to offering vaccination to asbestos subjected people who are really at high risk connected with developing long run asbestos associated malignancies. Thanks for sharing your ideas on this important ailment.

Casino sign up online with new customers get a $350 free chip. All you need to do is try out their 3-reel slots and make $25 on your first deposit, no deposit bonus available.

https://247pokies.com/bonza-spins-casino/

Meds information for patients. Effects of Drug Abuse.

get zoloft

Best about medicines. Read information here.

Medicines information sheet. Cautions.

levaquin brand name

Everything information about pills. Read information here.

Medicament information. Generic Name.

flagyl

Some information about meds. Get now.

Enjoy the thrill of casino play with this top-rated card game.

https://luckygames.ws/wild-card-city-casino.html

All trends of meds. Read information here.

what is lisinopril prescribed for

Best news about pills. Get here.

Medicines information for patients. What side effects can this medication cause?

buy generic zoloft

All news about drugs. Read information here.

Drug information. Drug Class.

lioresal

Actual what you want to know about meds. Read now.

Meds information for patients. Short-Term Effects.

nexium sale

Some news about meds. Get information here.

Pills information sheet. Brand names.

lisinopril

All trends of medicine. Read information here.

Actual about medication. Read information now.

lisinopril dosing

Actual news about meds. Read now.

I have been reading out a few of your articles and it’s pretty good stuff. I will definitely bookmark your website.

Medication information leaflet. Short-Term Effects.

lisinopril without insurance

Everything information about medicament. Get now.

Medicament prescribing information. Brand names.

cytotec tablet

Actual information about medicine. Read here.

Best news about pills. Get now.

prednisone 10 mg

Actual trends of medicine. Read here.

Casino play online,offering the best casino games

https://www.latestnigeriannews.com/p/2221975/how-to-choose-the-best-pokie-to-win-at-an-australian-online-casino.html

1win зеркало

https://1wfcgw.top/

Drug information for patients. Long-Term Effects.

nexium

Everything trends of drug. Get information here.

Welcome to the best online casino in the world. The best place to play casino games and slots, blackjack, keno, poker and more.

https://www.ff-winners.com/wild-card-city-online-casino-real-money/

Picture this – 3 am in the morning, I had a line of fiends stretched around the corner of my block. It was in the freezing middle of January but they had camped out all night, jumping-ready to buy like there was a sale on Jordans. If you were 16 years old, in my shoes, you’d do anything to survive, right? I got good news though; I MADE IT OUT OF THE HOOD, with nothing but a laptop and an internet connection. I’m not special or lucky in any way. If I, as a convicted felon that used to scream “Free Harlem” around my block until my throat was sore, could find a way to generate a stable, consistent, reliable income online, ANYONE can! If you’re interested in legitimate, stress-free side hustles that can bring in $3,500/week, I set up a site you can use: https://incomecommunity.com

Drug information sheet. Effects of Drug Abuse.

strattera

Actual about pills. Get information now.

Meds information. What side effects can this medication cause?

synthroid buy

Everything news about drugs. Get information now.

The internet has changed the way we play and gamble, but it’s also made it easier than ever to find the best online casinos. Whether you’re looking for a high-end casino with a wide selection of games, or one that enables players to rely on pay-outs in convenient ways, we offer a variety of options that fit your style.

https://www.latestnigeriannews.com/p/2221975/how-to-choose-the-best-pokie-to-win-at-an-australian-online-casino.html

Medication information sheet. Drug Class.

pregabalin

Everything news about medicines. Read here.

Medicines information for patients. Effects of Drug Abuse.

cheap flagyl

Some news about drug. Get information now.

Ultimate casino experience is right here. Play at your favourite casino and start winning now.

https://www.australiaunwrapped.com/benefits-of-playing-at-casinos-in-australia/

Автор 24

автор24

Medicament prescribing information. What side effects?

pregabalin

All news about pills. Get information here.

Medicine information leaflet. Effects of Drug Abuse.

cefixime online

Best information about meds. Read now.

Medication information sheet. What side effects?

cheap cleocin

Some about meds. Get here.

Medicine information sheet. Effects of Drug Abuse.

celebrex tablets

Everything news about meds. Get information here.

Drug information leaflet. Cautions.

buy generic levaquin

Everything about pills. Get information now.

Everything about medicines. Read information here.

can i order cheap levaquin without insurance

Best news about drug. Get information here.

Medicines information. What side effects?

levaquin

Best what you want to know about medicine. Read now.

Drugs information leaflet. Brand names.

get levaquin

Best what you want to know about medicine. Get here.

Medicine information sheet. Brand names.

neurontin

Actual what you want to know about drugs. Read here.

I’d like to find out more? I’d love to find out more details.

Drugs information sheet. Short-Term Effects.

buy colchicine

Everything information about pills. Get information here.

May I request that you elaborate on that? Your posts have been extremely helpful to me. Thank you!

Thank you for writing this post. I like the subject too.

Pills information for patients. Cautions.

flagyl tablets

Everything news about medication. Get information here.

Drug prescribing information. What side effects?

stromectol price

All about meds. Get information now.

Meds information leaflet. Long-Term Effects.

med-info-pharm.top otc

Actual what you want to know about meds. Get here.

Everything what you want to know about drugs. Read information now.

levaquin for sale

Actual information about meds. Get information here.

https://mircare.com/en/citizenship-and-residence/usa&CAUTION-FRAUD

Pills information for patients. Short-Term Effects.

med-info-pharm.top cheap

All about meds. Get now.

Some news about medicament. Read information now.

where can i buy generic levaquin online

Best news about medicines. Read information here.

Medication information leaflet. Cautions.

singulair

Best about medication. Get information here.

Everything what you want to know about medicine. Get here.

can i get cheap levaquin

All information about drugs. Read information here.

Medication prescribing information. Brand names.

avodart

Best trends of medicine. Read now.

Pills prescribing information. Cautions.

where buy cephalexin pills in USA

Actual news about medicine. Get information now.

http://novosibdom.ru/kalkulyator-kredita-onlayn-i-drugie-poleznye-servisy-ot-bankiru

Hi tailoredbytaylor.net admin, Your posts are always informative.

deltasone to buy

Nicely put. Thanks.

My web blog; https://trazodone4world.top

dual citizenship scam

Helpful posts Many thanks!

Also visit my webpage; http://0831ly.com/space-uid-771181.html?do=profile

Medicine information sheet. Short-Term Effects.

can i purchase generic propecia tablets in Canada

Everything trends of medicines. Read information now.

http://onegadget.ru/og/66779

Thank you for writing this post. I like the subject too.

Great beat ! I would like to apprentice while you amend your web site, how could i subscribe for a blog site? The account helped me a acceptable deal. I had been a little bit acquainted of this your broadcast provided bright clear concept

Meds information leaflet. Drug Class.

propecia

Everything news about pills. Read now.

Actual information about medication. Read information now.

ivermectin

Everything about drugs. Read information here.

Pills information. What side effects can this medication cause?

strattera cheap

All information about drugs. Get information here.

Everything news about pills. Read here.

clindamycin 300 mg

Best about meds. Read information here.

Whoa loads of great knowledge.

My site; https://www.hirehomeservice.com/keep-away-from-the-top-10-mistakes-made-by-starting-seroquel/

1xbet promo code. Click Here:👉 http://https://www.lafp.org/includes/pages/1xbet-promo-code-1xbet-bonus.html

Meds information. What side effects can this medication cause?

lioresal

Some information about drugs. Get now.

Medicine information. Brand names.

buy neurontin

Actual news about drug. Get now.

Everything trends of medicines. Get information here.

how much ashwagandha daily

Actual news about meds. Read now.

Drug information for patients. Brand names.

how can i get protonix

Actual what you want to know about medicament. Read now.

Please provide me with more details on the topic

Everything trends of medicine. Read information now.

lisinopril 5 mg

All news about medicament. Get information here.

Medicine information leaflet. Brand names.

buy proscar

Everything information about medicine. Get information here.

Incredible tons of great material.

Here is my website – all bitcoin online casino play free (https://noblue.co.il/test/community/profile/bahamut1988/)

Medication information sheet. Effects of Drug Abuse.

cost neurontin

Everything news about medicines. Get information here.

Medicine information leaflet. Brand names.

zovirax without a prescription

All trends of drug. Get information now.

This is nicely put. !

my website http://www.scriptarchive.com/demos/guestbook/guestbook.html – http://cse.google.co.ao/url?sa=t&url=http%3A%2F%2Fwww.scriptarchive.com%2Fdemos%2Fguestbook%2Fguestbook.html –

http://www.jscallvan.com/bbs/board.php?bo_table=free&wr_id=635837

Medicine information sheet. Generic Name.

cost neurontin

Actual trends of medicament. Read here.

The 35% discount mechanically applies to your first-time,

qualifying Repeat Delivery purchase and is mirrored

in the “Promotions” line in your Order Summary at Checkout.

Hola a todos, francamente Linkedin es una mina de negocios.

¿Quieren ahorrar tiempo en su búsqueda de LinkedIn? ¡Nuestra herramienta de generación de operadores de Google lo hará más rápido y eficiente!

Si quieren probar la herramienta (que además es gratuita, vayan al enlace) Amón

You have made your point.

Look into my webpage … https://seroquel2all.top

http://impactodivino.com/-/index.php?option=com_kide

Keep on writing, great job!

To the tailoredbytaylor.net administrator, Your posts are always well written.

Hi tailoredbytaylor.net webmaster, Keep up the good work!

Meds information for patients. Drug Class.

levaquin without dr prescription

Some information about medication. Read now.

Everything news about drug. Get information here.

youtheory ashwagandha

All news about medicament. Get here.

What’s up colleagues, its fantastic paragraph concerning educationand completely defined, keep it up all the

time.

prednisone 25 mg acquisto on line

To the tailoredbytaylor.net owner, Keep up the good work, admin!

Medicament information for patients. Generic Name.

lioresal

Everything about pills. Read here.

автор 24 ру

Dear tailoredbytaylor.net webmaster, You always provide valuable feedback and suggestions.

Pills prescribing information. Short-Term Effects.

propecia tablets

Actual news about medicament. Read here.

Dear tailoredbytaylor.net owner, You always provide great examples and case studies.

Have you ever thought about publishing an ebook or

guest authoring on other websites? I have a blog based upon on the same topics you discuss and would really like

to have you share some stories/information. I know my subscribers would enjoy your work.

If you are even remotely interested, feel free to send me

an e-mail.

Thanks for this Quality piece. Do you reckon I can integrate it with lazytraffic.com? I would really love to have your take on it. Thank you

Drug information. What side effects?

neurontin pill

Actual news about drugs. Get information here.

Medicines information leaflet. Long-Term Effects.

cost of singulair

All trends of medicament. Get here.

Let me give you a thumbs up man. Can I tell you my secret

ways on amazing values and if you want to have a checkout

and also share valuable info about how to make

a fortune yalla lready know follow me my fellow commenters!.

Some what you want to know about medicine. Read information now.

singulair allergy medicine

Everything trends of drugs. Read here.

Pills information for patients. Effects of Drug Abuse.

celebrex

Best information about medication. Read information now.

Medicine information for patients. Drug Class.

levaquin rx

Best about meds. Get information here.

Pills information. What side effects?

avodart

All about drug. Read information now.

Medicines information sheet. Cautions.

cephalexin

All news about medication. Read information here.

I have read so many articles or reviews concerning

the blogger lovers except this post is in fact a good post, keep it

up.

Hello tailoredbytaylor.net owner, You always provide in-depth analysis and understanding.

Roo online casino offers fast and convenient payment methods to make it easy for you to deposit and withdraw your winnings. You can choose from a range of options, including credit cards, e-wallets, and more. All transactions are processed quickly and securely, so you can enjoy seamless and hassle-free gaming.

https://www.cbrmma.com.au/forum/general-discussion/why-should-you-pay-attention-to-roo-casino-in-australia

Legal compliance: Make sure your agency is compliant with all local and national laws and regulations.

YouTube options

easy buy fake passport

Meds information for patients. Drug Class.

lyrica price

Some news about medication. Get now.

The articles you write help me a lot and I like the topic

Medicine prescribing information. Brand names.

propecia

Actual about drug. Read information here.

“Experience the Thrill of Online Gaming with Roo online Casino Login”

http://bbs.ddcnc.com/forum.php?mod=viewthread&tid=1722&extra=

Medicines information for patients. Effects of Drug Abuse.

cephalexin pill

Best trends of drug. Get now.

Hello tailoredbytaylor.net admin, You always provide great resources and references.

Roo Casino is a top-rated online gambling platform that offers an exciting and secure gaming experience.

https://www.everyfamily.com.au/online-community/topic/what-is-roo-casino-in-australia/

Meds information for patients. What side effects?

buy generic mobic

Everything information about drug. Get information here.

This piece of writing will assist the internet visitors for creating new website

or even a weblog from start to end.

Drug prescribing information. Effects of Drug Abuse.

neurontin sale

Best news about medicament. Get now.

melbet promo code registration Click Here:👉 https://www.nationallobsterhatchery.co.uk/news/melbet_promo_code__sign_up_offer.html

Medicine information leaflet. Effects of Drug Abuse.

lyrica cheap

Actual trends of drugs. Get information now.

If you’re looking for a user-friendly online casino experience, Roo Casino is the perfect choice. With an easy-to-use platform and 24/7 customer support, you can play your favorite games with ease. Whether you’re a seasoned gambler or just starting out, you’ll love the simplicity and convenience of playing at Roo Casino.

https://www.theloop.com.au/project/Antina/portfolio/the-main-advantages-of-roo-casino-in-australia/462575

All what you want to know about drugs. Get now.

purchase singulair online

All news about medicine. Get now.

Drug information sheet. Brand names.

get celebrex

Some information about medication. Get now.

To the tailoredbytaylor.net webmaster, Excellent work!

Hi tailoredbytaylor.net administrator, Keep up the good work!

Roo Casino is dedicated to responsible gambling and takes all necessary measures to ensure the safety and security of its players.

https://www.foundation.hawthornfc.com.au/forum/welcome-to-the-forum/what-can-surprise-roo-casino

I visited multiple websites but the audio quality for audio

songs current at this web site is really fabulous.

My spouse and I absolutely love your blog and find almost all of your post’s to be just

what I’m looking for. Does one offer guest writers to write content to suit your needs?

I wouldn’t mind publishing a post or elaborating on most of the subjects you write related to here.

Again, awesome web log!

If you’re looking for a safe and secure online casino, Roo Casino is the perfect choice. With top-notch security measures in place and a fully licensed and regulated platform, you can trust that your information and funds are safe and secure. And with 24/7 customer support, you can have peace of mind knowing that help is always available if you need it.

http://www.chambers.com.au/forum/view_post.php?frm=3&pstid=25046

Drug information. Short-Term Effects.

propecia online

Actual about drug. Get now.

If you’re looking for a safe and secure online casino, Roo Casino is the perfect choice. With top-notch security measures in place and a fully licensed and regulated platform, you can trust that your information and funds are safe and secure. And with 24/7 customer support, you can have peace of mind knowing that help is always available if you need it.

https://www.jeremiahspropertyservice.com.au/forum/welcome-to-the-forum/roo-casino-everything-about-a-gambling-establishment-in-australia

Medicine prescribing information. Short-Term Effects.

buy lyrica

Best information about medicines. Get now.

Drugs information. Long-Term Effects.

sildenafil

Actual what you want to know about meds. Read information now.

Pretty! This has been an incredibly wonderful article.

Many thanks for supplying these details.

Pills information sheet. Generic Name.

lyrica online

Actual trends of pills. Get now.

Medicine information sheet. Effects of Drug Abuse.

generic propecia

All what you want to know about medicines. Get information here.

Meds prescribing information. Generic Name.

strattera

Actual what you want to know about medication. Read now.

Pills information. Effects of Drug Abuse.

lioresal rx

Best information about drug. Read information here.

Good web site! I truly love how it is easy on my eyes and the data are well written. I am wondering how I could be notified whenever a new post has been made. I’ve subscribed to your RSS which must do the trick! Have a nice day!

thai swingers

Medicament information leaflet. What side effects can this medication cause?

buying mobic

All what you want to know about medicament. Read information now.

You’ve been great to me. Thank you!

Pills prescribing information. Long-Term Effects.

neurontin sale

Best trends of meds. Read here.

I haven¦t checked in here for a while since I thought it was getting boring, but the last several posts are great quality so I guess I will add you back to my everyday bloglist. You deserve it my friend 🙂

Great content! Super high-quality! Keep it up!

Drugs information leaflet. Cautions.

avodart prices

Best information about drug. Read information here.

buy fake residence permit

Medication information for patients. Drug Class.

lyrica

Best information about medicines. Read here.

How can I find out more about it?

Online casino deposit bonus

ggbet

Medicine information for patients. Effects of Drug Abuse.

propecia pills

Some about medicament. Read here.

https://nadom-moscow3.top/

joo casino canada

промышленные бетонные полы

Medicine prescribing information. Brand names.

buy generic flibanserina

Best about medicines. Get information here.

Are you ready to take your gaming experience to the next level? Sign up for Roo Casino today and get access to generous bonuses and special offers. With a huge selection of games and easy access through a web browser or mobile device, you’ll never want to leave. Whether you’re looking to win big or just play for fun, Roo Casino is the perfect choice.

https://www.nigeriansocietyvic.org.au/forum/general-discussions/roo-casino-is-one-of-the-best-in-australia

888sport casino

Online new zealand pokies

No deposit casino

Some information about medicines. Read information now.

lisinopril medication recall

All what you want to know about drug. Get here.

установка drillkomplekt

steam desktop authenticator

Thank you for your post. I really enjoyed reading it, especially because it addressed my issue. It helped me a lot and I hope it will also help others.

Actual news about drug. Get information now.

medication singulair 10 mg

Best what you want to know about meds. Get information now.

Hello tailoredbytaylor.net administrator, Your posts are always thought-provoking and inspiring.

Hello tailoredbytaylor.net administrator, Your posts are always well written.

2023 Vea las ъltimas noticias sobre patrimonio neto, edad, altura y biografнa. – Cuanto Mide Bad Bunny 2023 Cuanto Mide Bad Bunny 2023

Thank you for your post. I really enjoyed reading it, especially because it addressed my issue. It helped me a lot and I hope it will also help others.

You helped me a lot with this post. I love the subject and I hope you continue to write excellent articles like this.

2023 Sehen Sie sich die neuesten Nachrichten zu Verm?gen, Alter, Gr??e und Biografie an – Katja Krasavice verm?gen Katja Krasavice vermцgen

Thank you for your articles. They are very helpful to me. May I ask you a question?

Please tell me more about your excellent articles

Drugs information for patients. Drug Class.

propecia

Some trends of meds. Get here.

Some what you want to know about pills. Read now.where can you buy prednisone

Actual information about medicament. Get now.

Medicament information leaflet. Generic Name.

fosamax

Some trends of meds. Read information now.

Actual about medicament. Read information here.

how to take ashwagandha

Best trends of pills. Read information here.

Drugs information sheet. Long-Term Effects.

zithromax

Some information about pills. Read information now.

Actual trends of drugs. Read information here.

stromectol stromectolverb

All about medication. Get information here.

Medication information leaflet. Drug Class.

levaquin order

Some information about medicament. Get information now.

Pills information for patients. What side effects?

cordarone

All about medication. Get information now.

Medicines information leaflet. Brand names.

can you get mobic

Best what you want to know about medicine. Read now.

n1 casino

Some information about meds. Read here.

buy singulair generic

Actual about medication. Read now.

How can I find out more about it?

Medicine information leaflet. Cautions.

singulair

All about drug. Read here.

Pills prescribing information. Cautions.

pregabalin generic

Everything trends of drugs. Get here.

Some trends of medicine. Read here.

online prescription cefixime 400

Everything trends of meds. Read here.

Hi tailoredbytaylor.net owner, Your posts are always insightful and valuable.

Thank you for your post. I really enjoyed reading it, especially because it addressed my issue. It helped me a lot and I hope it will also help others.

Thank you for your articles. I find them very helpful. Could you help me with something?

Pills prescribing information. Effects of Drug Abuse.

baclofen price

Actual trends of meds. Read now.

Good web site! I truly love how it is easy on my eyes and the data are well written. I am wondering how I could be notified whenever a new post has been made. I’ve subscribed to your RSS which must do the trick! Have a nice day!

Thank you for writing this post!

Actual information about medicine. Get here.

colchicine warnings

Best about medicines. Get information now.

Great content! Super high-quality! Keep it up!

Sustain the excellent work and producing in the group!

Hi tailoredbytaylor.net administrator, Thanks for the informative and well-written post!

Thank you for writing this article. I appreciate the subject too.

https://100rt.ru

https://joycasino-zerk08.top

Drugs information leaflet. What side effects?

cheap mobic

All information about drug. Get now.

Remarkable! Its genuinely amazing paragraph, I have got much

clear idea concerning from this piece of writing.

The articles you write help me a lot and I like the topic

Thanks for helping out, wonderful info .

Drug information for patients. Cautions.

cost pregabalin

Best news about medicines. Get here.

I believe that a home foreclosure can have a major effect on the client’s life. Mortgage foreclosures can have a 6 to decade negative influence on a debtor’s credit report. A new borrower having applied for home financing or any kind of loans even, knows that a worse credit rating is actually, the more challenging it is to acquire a decent mortgage. In addition, it might affect the borrower’s ability to find a good place to lease or hire, if that turns into the alternative housing solution. Great blog post.

Thank you for writing this post!

https://www.easyworknet.com/misc/top-rated-online-casino-bambet/

Hello tailoredbytaylor.net webmaster, Keep up the good work, admin!

Thank you for your articles. I find them very helpful. Could you help me with something?

Phone Number For Reservations:👉 http://rentry.co/v7mdh

I want to thank you for your assistance and this post. It’s been great.

Please tell me more about this. May I ask you a question?

https://mondaystars.com/

Medicine information for patients. Effects of Drug Abuse.

baclofen

All information about medication. Get here.

facesitting fetish

Hello tailoredbytaylor.net admin, Thanks for the informative post!

All news about drug. Get information here.

stromectol scabies beauty

Best news about drug. Get now.

you are really a good webmaster. The web site loading speed is amazing. It seems that you’re doing any unique trick. Moreover, The contents are masterpiece. you have done a excellent job on this topic!

https://t20worldcuplivescore.com/bambet-casino-review-is-it-safe-and-worth-to-play/

Veito Blade S Silver

Medication information sheet. Brand names.

lyrica

All about medicament. Get information here.

Thanks for your thoughts. One thing we’ve noticed is always that banks plus financial institutions understand the spending routines of consumers and also understand that a lot of people max out and about their real credit cards around the trips. They wisely take advantage of this particular fact and begin flooding the inbox plus snail-mail box along with hundreds of 0 APR credit cards offers soon after the holiday season concludes. Knowing that if you are like 98 in the American public, you’ll jump at the one opportunity to consolidate financial debt and shift balances towards 0 interest rate credit cards.

I been reviewing online more than five hours today for https://cheapwinnipegpainting.blogspot.com/ & Personal Budgeting Made Easy, yet I never found any interesting article like yours. It is pretty worth enough for me. In my view, if all site owners and bloggers made good content as you did, the internet will be much more useful than ever before.

Thank you, I have recently been looking for information about this subject for a while and yours is the greatest I’ve discovered till now. But, what about the bottom line? Are you certain in regards to the source?

Some information about drugs. Read now.

buy generic cleocin now

Everything about medicines. Get information here.

Meds information. Long-Term Effects.

lioresal

Best about medicament. Read now.

Cum on my mouth: Clitoris

https://www.easyworknet.com/misc/top-rated-online-casino-bambet/

Royalzysk opinie

I will immediately grasp your rss feed as I can not to find your e-mail subscription link or newsletter service. Do you’ve any? Kindly allow me know in order that I may subscribe. Thanks.

Meds information leaflet. Drug Class.

flibanserina

Actual information about drug. Read here.

Hello tailoredbytaylor.net admin, Your posts are always well-balanced and objective.

This is nicely put! !

Feel free to surf to my page: casino [http://en.easypanme.com/board/bbs/board.php?bo_table=master&wr_id=17366]

Medication information for patients. Short-Term Effects.

levaquin otc

All what you want to know about drug. Read now.

Royalzysk.com Recenzja

Medicine information. Effects of Drug Abuse.

pregabalin buy

Some trends of meds. Get now.

WONDERFUL Post.thanks for share..extra wait .. ?

Actual what you want to know about medication. Get here.

protonix

Some news about drug. Get now.

Medicines information. What side effects?

prednisone

Everything about drugs. Get here.

Best news about meds. Get information now.

terramycin antibiotic

Actual what you want to know about drugs. Get now.

There’s noticeably a bundle to find out about this. I assume you made sure nice points in features also.

hi!,I like your writing very much! share we communicate more about your article on AOL? I require an expert on this area to solve my problem. Maybe that’s you! Looking forward to see you.

1xbet best promo code. Click Here:👉 https://www.lafp.org/includes/pages/1xbet-promo-code-1xbet-bonus.html

Pills information for patients. Drug Class.

propecia

Best news about medicament. Read information here.

Wonderful items from you, man. I have consider your stuff prior to and you are just too great. I really like what you’ve got right here, certainly like what you are saying and the best way during which you say it. You make it enjoyable and you still take care of to keep it smart. I can’t wait to learn much more from you. That is actually a great website.

Hi tailoredbytaylor.net administrator, Your posts are always well-structured and logical.

Meds information. What side effects can this medication cause?

buy nexium

Some about medicament. Get now.

You need to participate in a contest for one of the best blogs on the web. I will advocate this website!

All news about pills. Get here.what is prednisone used for

Some about medicine. Read now.

I have been browsing online more than 3 hours lately, but I by no means found any attention-grabbing article like yours. It is beautiful value enough for me. In my opinion, if all web owners and bloggers made good content as you probably did, the web will probably be a lot more useful than ever before.

I loved your post! I’ve had great success integrating your suggestions with the SEO strategies from gtpedia.com. Have you tried using those techniques together?

I loved as much as you will receive carried out right here. The sketch is tasteful, your authored material stylish. nonetheless, you command get got an impatience over that you wish be delivering the following. unwell unquestionably come further formerly again since exactly the same nearly a lot often inside case you shield this hike.

casino hacks to win

Drug information for patients. Effects of Drug Abuse.

sildenafil

Best news about medicines. Get information here.

Thank you a bunch for sharing this with all folks you really know what you are talking about! Bookmarked. Kindly additionally visit my web site =). We could have a hyperlink trade contract between us!

Why users still make use of to read news papers when in this technological world all is available on web?

Feel free to visit my web-site – Treating the patient as a whole person

Hey! Check this site full of deals!

https://www.amazoniadeals.com

air duct cleaning

buy fake documents uk

Also I believe that mesothelioma cancer is a extraordinary form of cancer that is normally found in these previously subjected to asbestos. Cancerous cells form within the mesothelium, which is a protecting lining which covers almost all of the body’s areas. These cells typically form from the lining with the lungs, abdomen, or the sac which encircles one’s heart. Thanks for expressing your ideas.

casino slots machine

Drugs prescribing information. Short-Term Effects.

celebrex medication

All news about medicine. Read information here.

I enjoyed reading your piece and it provided me with a lot of value.

Thank you for writing this post!

Pills information for patients. What side effects can this medication cause?

where can i buy cephalexin

Everything about medicines. Read information now.

Everything trends of medicines. Read information here.

cheap fluoxetine online

Everything about pills. Get now.

To the tailoredbytaylor.net administrator, Thanks for the informative and well-written post!

Some what you want to know about drug. Read information here.

buy tetracycline without prescription

Actual news about pills. Get information here.

Thanks for posting. I really enjoyed reading it, especially because it addressed my problem. It helped me a lot and I hope it will help others too.

Thanks a bunch for sharing this with all of us you really know what you’re talking about! Bookmarked. Kindly also visit my site =). We could have a link exchange contract between us!

Wonderful goods from you, man. I’ve understand your stuff previous to and you’re just extremely great. I actually like what you have acquired here, certainly like what you’re stating and the way in which you say it. You make it enjoyable and you still care for to keep it wise. I can’t wait to read far more from you. This is actually a terrific website.

Everything what you want to know about meds. Get here.

where to buy singulair online in arizona

Best about meds. Read now.

Sustain the excellent work and producing in the group!

I have observed that over the course of developing a relationship with real estate proprietors, you’ll be able to come to understand that, in most real estate financial transaction, a payment is paid. Finally, FSBO sellers never “save” the percentage. Rather, they try to earn the commission by simply doing the agent’s occupation. In the process, they invest their money as well as time to accomplish, as best they could, the jobs of an real estate agent. Those responsibilities include uncovering the home by way of marketing, presenting the home to willing buyers, building a sense of buyer desperation in order to trigger an offer, organizing home inspections, managing qualification inspections with the mortgage lender, supervising fixes, and aiding the closing.

Excellent website. Lots of useful information here. I?m sending it to a few pals ans additionally sharing in delicious. And of course, thank you to your effort!

Medicines information sheet. Short-Term Effects.

sildenafil prices

Actual news about drug. Get here.

Can you write more about it? Your articles are always helpful to me. Thank you!

You’ve the most impressive websites.

actos tablets